1. Business Accelerator Programme (BAP)

a. Objectives

- To enhance capabilities of micro, small and medium enterprises.

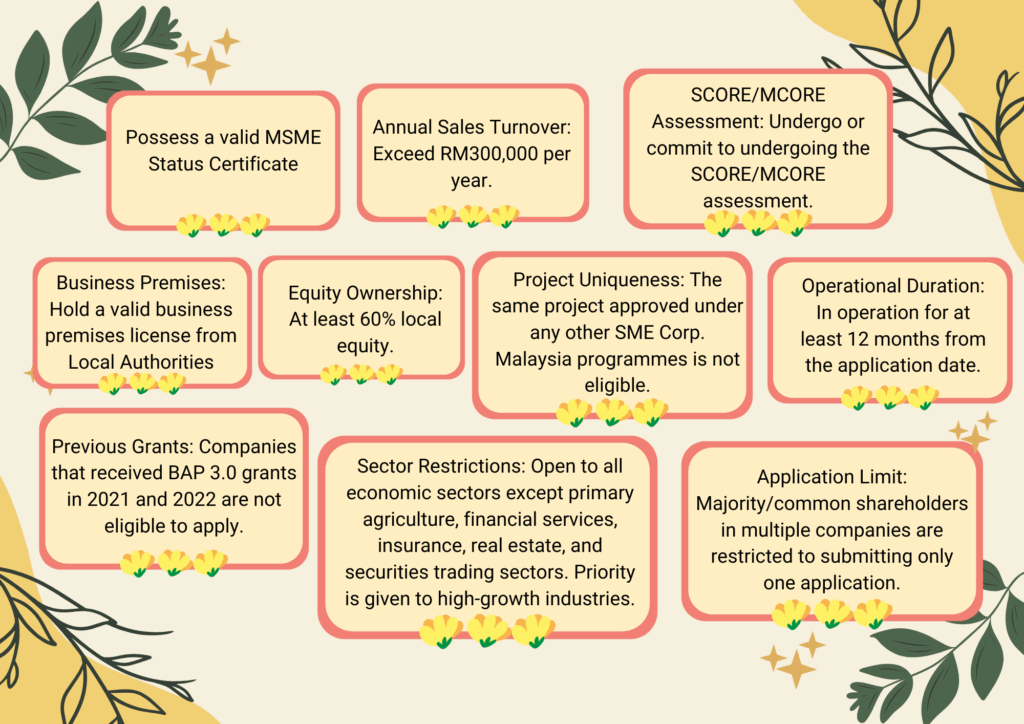

b. Criteria

c. Financing

Two types of financing are available under the Business Accelerator Programme (BAP) :

1. Matching Grant

- 50% of eligible expenses, with a maximum of RM400,000.

- Reimbursement basis.

- Eligible expenses include:

- Acquisition of machinery & equipment (productivity & automation).

- ICT adoption & e-commerce.

- ESG (Environment, Social & Governance) adoption.

- Product certification.

- Advertising & promotion (limited to RM50,000).

- Processing fees: RM500 for application, RM300 for appeals.

2. Soft Loan (in collaboration with SME Bank)

- Minimum: RM100,000; Maximum: RM500,000.

- Profit rate: 3.5% per annum.

- Margin of financing: Up to 100%.

- Financing tenure: Up to 7 years, including a grace period of not more than 12 months.

- No collateral required.

- Takaful/insurance coverage is mandatory if the asset is given as security for the financing.

- Fees and charges apply; refer to the Product Disclosure Sheet for details.

d. Further Information

Application for Business Accelerator Programme can be made online through the website http://www.smecorp.gov.my/vn2/node/35

For further information please contact:

SME Corporation Malaysia

Level 6, SME 1, Block B,

Platinum Sentral

Jalan Stesen Sentral 2

Kuala Lumpur Sentral,

50470 KUALA LUMPUR

General Line: 03-2775 6000

Fax Line: 03-2775 6001

Info Line 1-300-30-6000

Email: [email protected]